Corporate Tax & VAT

Book a Free Consultation With Our Experts

Corporate tax in the UAE is a new initiative aimed at diversifying revenue sources, ensuring transparency, and fostering economic growth. This measure requires all businesses to comply with specific rates and regulations to support the UAE’s competitive environment.

Value Added Tax (VAT), introduced in January 2018, is a consumption tax set at a standard rate of 5% on most goods and services. It applies to businesses meeting certain thresholds and is designed to further diversify revenue sources. The VAT system mandates businesses to register, collect tax, file returns, and maintain accurate records.

Key Corporate Tax Requirements

- Register for corporate tax starting June 2023.

- Maintain accounting records according to required standards (e.g., IFRS).

- File a corporate tax return with the Federal Tax Authority.

Even if a business is exempt from paying corporate tax, it must still register and follow these steps to determine its exemption status.

Key VAT Requirements

- Mandatory Registration: Required if your company’s taxable goods and services exceeded AED 375,000 in the past 12 months or is expected to exceed AED 375,000 in the next 30 days.

- Voluntary Registration: Optional if your company’s taxable goods and services exceeded AED 187,500 in the past 12 months or is expected to exceed AED 187,500 in the next 30 days.

Our Corporate Tax Services

Corporate Tax Advice

Our experts will guide you on all aspects of corporate tax affecting your business. This includes identifying potential tax exemptions and helping you take advantage of them.

Corporate Tax Registration

Our team will help you register your business for corporate tax with the FTA and manage all deadlines for your tax obligations.

Corporate Tax Returns

Our team will review your tax position, ensure you get the best outcome, and handle all required filings with the FTA throughout the year.

Our VAT Services

Tax Consultation

Speak with our qualified tax experts for customized planning to achieve efficient tax outcomes and ensure compliance with all obligations. We also assist in securing individual or corporate tax residency certificates from the Federal Tax Authority.

VAT Registration (TRN)

Our in-house accountants will handle your VAT registration with the FTA, advice on VAT exception eligibility, and issue your Tax Registration Number (TRN) certificate.

VAT Returns

Our team prepares quarterly VAT reports to help you determine if you have VAT payable/refund.

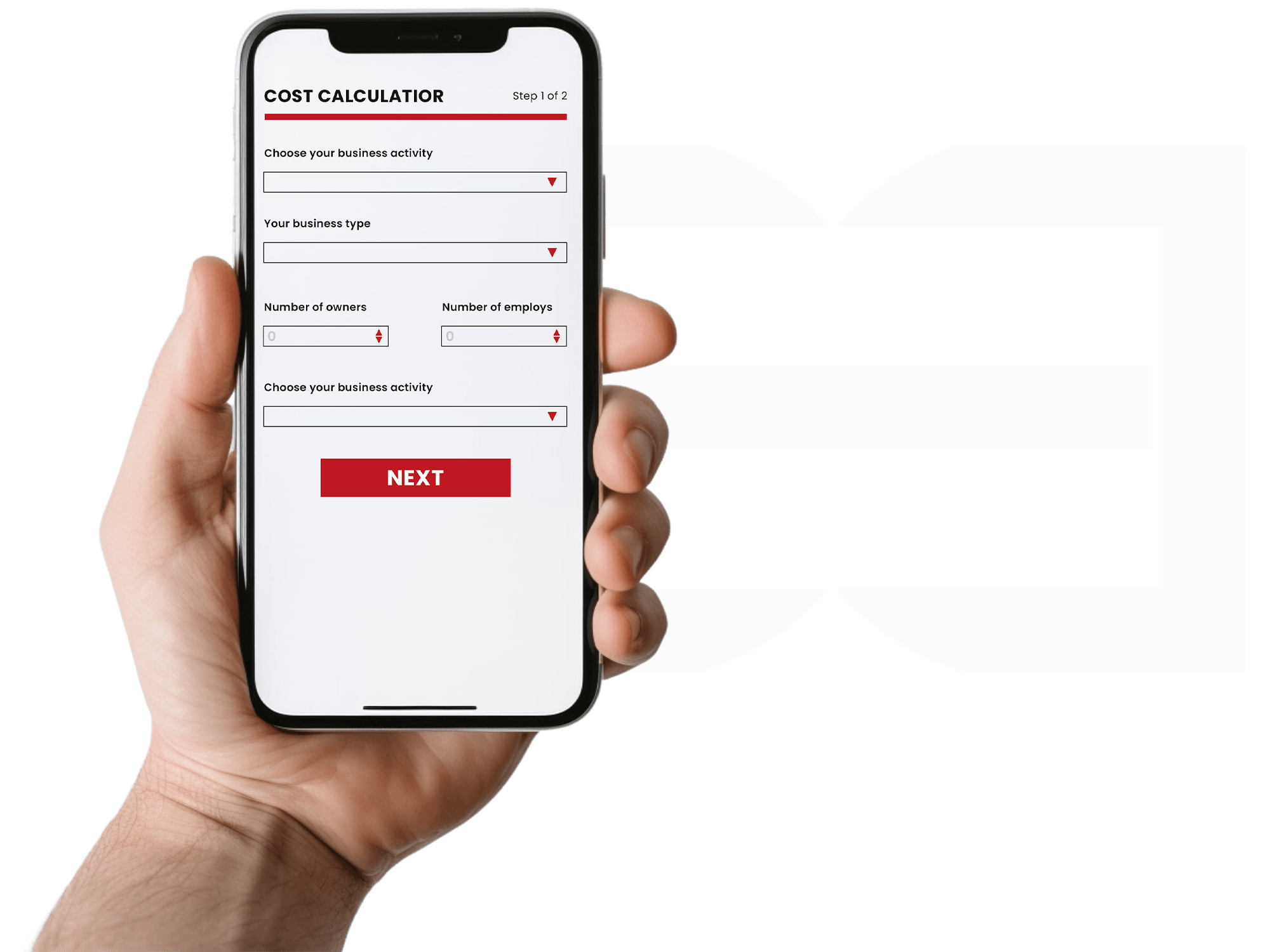

Estimate your business setup expenses

Tax Rates in the UAE

- 0% Tax Rate: For businesses with net annual profits up to AED 375,000.

- 9% Tax Rate: For businesses with net annual profits above AED 375,000.

- 15% Tax Rate: For large multinational companies with total global revenue over EUR 750 million

- 5% Tax Rate: For businesses with taxable goods and services exceeding AED 375,000.

- 0% Tax Rate: Applied to specific goods and services, including international transport and certain healthcare and education services.

- Exemptions: Includes financial services, residential real estate, and certain educational services.

Process

Understanding your Requirements

Registering your Business with FTA

Maintain Accurate Invoices/Records

Calculate your Tax

Filing your Tax Return

Pay your Tax