Offshore Company Setup

Book a Free Consultation With Our Experts

Offshore company setup involves establishing a business in a jurisdiction outside one’s home country, often in a low-tax or tax-neutral environment. The benefits include tax savings, asset protection, and enhanced privacy for business owners and investors.

EMARAH CORPORATE SERVICES is here to make your offshore business setup easy and aligned with your goals. Our team will guide you through every step, helping you establish a successful presence in the UAE.

Benefits

- Complete exemption from corporate and income taxes, along with benefits like no VAT, capital gains tax, or inheritance tax.

- Asset protection and confidentiality.

- Access to global markets.

- Reduced regulatory requirements.

- 100% foreign ownership without a local partner.

- Enhanced privacy for owners.

- Lower operational costs.

- Simplified administration and reporting.

- No minimum share capital requirement.

Features

Company formation in 7-14 business days

Easy to Open a Bank Account

Minimal Paper work

100% Foreign Ownership

Real Estate Ownership

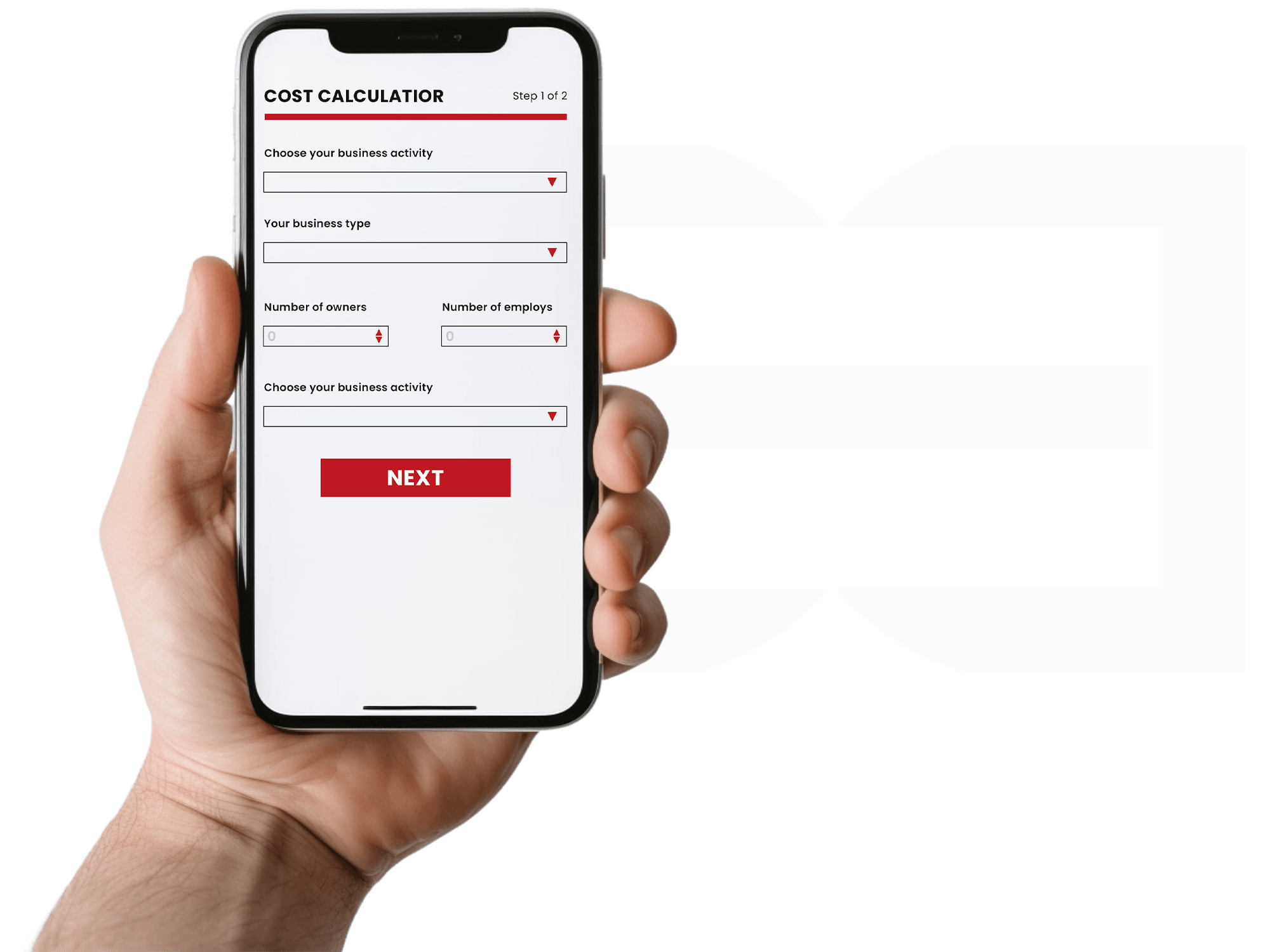

Estimate your business setup expenses

License Types and Activities

Offshore business licenses are typically issued for activities that do not involve conducting business directly within the UAE. Jebel Ali Free Zone (JAFZA), Ras Al Khaimah (RAK), and Ajman Free Zone (AFZ) are the “tax-free” jurisdictions specializing in offshore businesses.

Primarily used for holding and managing shares in other companies, assets, or investments. These companies often oversee subsidiaries and investments, but do not engage in commercial activities directly.

Allows for financial and investment activities such as managing portfolios, trading securities, or providing financial consultancy services. It does not permit direct business transactions within the UAE.

General Trading Offshore License allows a company to engage in a broad range of trading activities internationally, but it does not permit trading within the UAE.

Process for Offshore License

Choose Your Offshore Jurisdiction.

Select A Registered Agent.

Decide On Company Structure And Type.

Prepare Required Documents.

Submit Application And Pay Fees.

Await Approval From Offshore Authorities.